Disclaimer: Probate Consultants is not a legal practice. Information on this website about the law on any subject is general in nature and is intended to provide an outline only. It is not comprehensive, nor does it constitute legal or financial advice.

After someone close dies, dealing with their estate can be challenging for those left behind. In New South Wales (NSW), managing and distributing a deceased’s assets is governed by various legal procedures, with Probate playing a crucial role.

Obtaining a Grant of Probate from the Supreme Court of NSW is often a fundamental step in the estate administration process, ensuring that executors can prove their authority to administer the deceased’s Will to asset holders and other institutions.

This blog aims to demystify what happens after Probate is granted in NSW, guiding executors with useful information.

Probate Consultants empower Self-Represented Applicants (SRAs) to apply for Grants of Probate NSW by providing specialist guidance and support.

Call 1300 561 803 for a Free Consultation or book a time for call-back.

Next Steps Following the Grant of Probate

Once the Supreme Court of NSW grants Probate, executors can focus on administering the estate. The Grant of Probate is a green light, indicating to asset holders and other institutions that the Court has validated the Will and the executors’ authority to act on behalf of the estate.

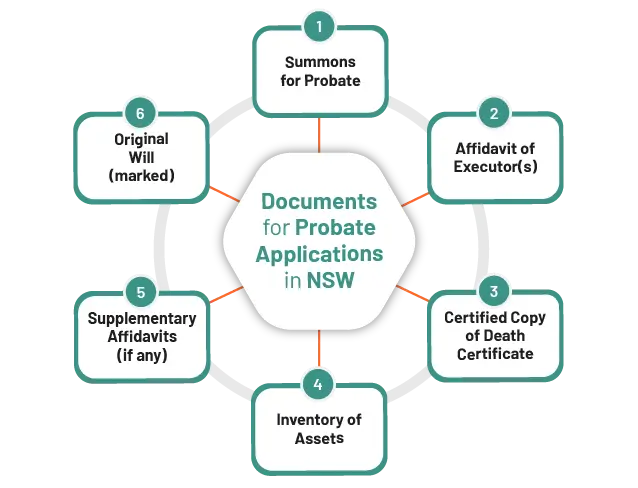

Estate administration involves three general steps:

- Collecting all property and assets

- Paying any debts

- Distributing the assets according to the Will

While executors can administer the estate as soon as Probate is granted, many opt to publish a Notice of Intended Distribution on the NSW Online Registry before distributing any assets. This notice informs the public that the executors intend to distribute the estate once:

- Six months have passed since the death of the deceased

- The Notice has been published for 30 days

Persons wishing to claim against the estate generally must do so within the specified time frames. Once the Notice of Intended Distribution has been published for 30 days, and 6 months have passed since the date of death, executors can distribute the estate, considering only the claims they are aware of at that time.

Distributing the Assets

Once debts are paid and tax liabilities calculated, executors can distribute the net estate to the beneficiaries according to their entitlements in the Will. Executors distribute the estate by transferring ownership of assets to the beneficiaries. It could involve transferring titles for real estate, transferring the ownership of shares or other investments, allocating funds from the deceased’s bank account, or physically handing over personal property. The process requires meticulous record-keeping, ensuring that each beneficiary receives their rightful share.

This phase of estate administration can be complex, especially when dealing with specific bequests or many beneficiaries. Executors must also be mindful of the potential for disputes among beneficiaries regarding the distribution of assets. Clear communication and adherence to the terms of the Will are crucial for navigating this stage successfully. Whilst beneficiaries have limited rights in relation to how the estate is managed, they can sue the executor if they feel the estate has been administered incorrectly or there has been a breach of legal obligations.

Finalising the Estate Administration

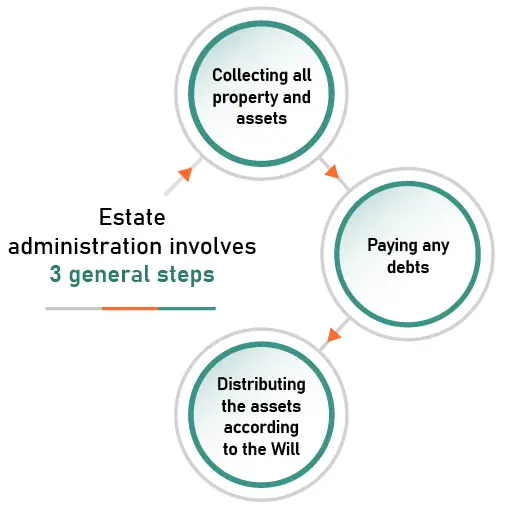

Once all debts have been paid, taxes settled, and assets distributed, the executor’s work is nearing completion. The final accounting is a crucial step, requiring the executor to prepare a detailed report of all actions taken to administer the deceased’s estate, including the following matters:

- Sale of assets

- Tax liabilities

- Payment of debts

- Expenses incurred during the administration process

- Distributions made to beneficiaries, including interim and final

This report is shared with the beneficiaries and, in some cases, filed with the Supreme Court of NSW.

Another step to consider is obtaining a release from the beneficiaries, acknowledging that they have received their entitlements and have no further claims against the estate. This release protects the executor from future claims regarding their estate administration.